Monetary policy is the process by which the government, central bank, or monetary authority of a country controls the supply of money, availability of money, and cost of money or rate of interest, in order to attain growth and stability of the economy.

Monetary policy is generally referred to as either being an expansionary policy, or a contractionary policy.

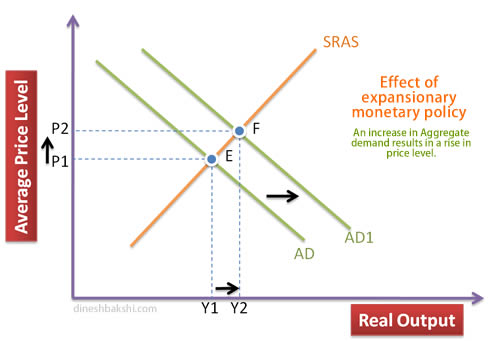

An expansionary policy increases the total supply of money in the economy and is traditionally used to combat unemployment in a recession by lowering interest rates. Lowered interest rates encourage the household and the firms to increase their consumption and investment respectively. This will shift the AD to the right and result in higher real output and more employment.

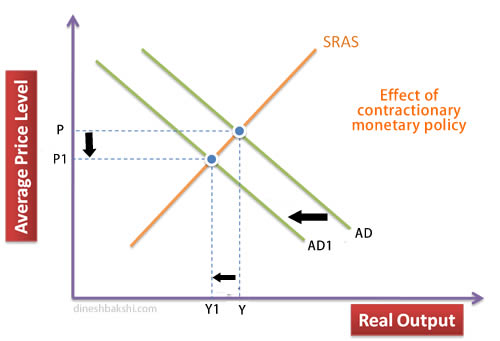

Contractionary policy decreases the total money supply and involves raising interest rates in order to combat inflation. The result will be that investment will fall, and consumption will fall. All of these changes will shift the AD to the left.

It is argued that an increase in the money supply causes an increase in the rate of inflation. Maintaining a low and stable inflation is one of the main macroeconomic objectives of the Government. Government does so by controlling the supply of money to the economy. This policy is known as monetary policy.

Monetary policy in any country is usually controlled by the Central Bank of that country. The Central bank alters the interest rates in the economy after assessing the inflationary pressures in the market.

Monetary Policy tools

Central Bank has three tools of monetary policy:

Open market operations

- Open market purchases: The central bank buys government securities to increase the monetary base.

- Open market sales: The central bank sells government securities to decrease the monetary base.

Open market operations have a number of advantages:

- They are under the direct and complete control of the central bank

- They can be large or small.

- They can be easily reversed.

- They can be implemented quickly

Discount loans

When a bank receives a discount loan from the central bank, it is said to have received a loan at the “discount window.” The Central Bank can a?ect the volume of discount loans by setting the discount rate:

- A higher discount rate makes discount borrowing less attractive to banks and will therefore reduce the volume of discount loans.

- A lower discount rate makes discount borrowing more attractive to banks and will therefore increase the volume of discount loans.

Discount lending is most important during ?nancial panics:

- When depositors lose con?dence in the ?nancial system, they will rush to withdraw their money.

- This large deposit out?ow puts the banking system in great need of reserves.

- The central bank stands ready to supply these reserves by making discount loans. In such situations, the central bank acts as a lender of last resort.

Changes in reserve requirements

The portion (expressed as a percent) of depositors' balances banks must have on hand as cash. This is a requirement determined by the country's central bank. It affects the money multiplier; changes in the required reserve ratio can lead to changes in the money supply. This is also referred to as the "cash reserve ratio" (CRR).

Central Banks

Central Banks are charged with regulating the size of a nation’s money supply, the availability and cost of credit, and the foreign-exchange value of its currency.  Regulation of the availability and cost of credit may be designed to influence the distribution of credit among competing uses. The principal objectives of a modern central bank in carrying out these functions are to maintain monetary and credit conditions conducive to a high level of employment and production, a reasonably stable level of domestic prices, and an adequate level of international reserves.

Regulation of the availability and cost of credit may be designed to influence the distribution of credit among competing uses. The principal objectives of a modern central bank in carrying out these functions are to maintain monetary and credit conditions conducive to a high level of employment and production, a reasonably stable level of domestic prices, and an adequate level of international reserves.

Function of a Central Bank

A central bank usually carries out the following responsibilities:

-

Implementation of monetary policy.

- Controls the nation's entire money supply.

- The Government's banker and the bankers' bank ("Lender of Last Resort").

- Manages the country's foreign exchange and gold reserves and the Government's stock register;

- Regulation and supervision of the banking industry

- Setting the official interest rates- used to manage both inflation and the country's exchange rate - and ensuring that this rate takes effect via a variety of policy mechanisms

For more information about the functions of various Central Banks click on the links below:

Bank of Indonesia

Central Bank of Malta

Central Bank of Yeman

Bank of England

Bank of Japan

To get an elaborate list of websites of Central bank of different countries click here.

Watch a Video

This video lesson graphically presents the three tools Central Banks have at their disposal for managing the level of aggregate demand in the economy. Through increasing or decreasing the money supply, a central bank has influence over the interest rates in a nation, and therefore over the level of investment and consumption among firms and households. To accomplish this, three tools are employed: The reserve requirement, the open market purchase or sale of government bonds, and the discount rate.This lesson illustrates these three tools and explains the relative importance of each to monetary policy makers.

The primary objective of the ECBs monetary policy is to maintain price stability. The ECB aims at inflation rates of below, but close to, 2% over the medium term.The operational framework of the Eurosystem consists of the following set of instruments:

Open market operations

Open market operations play an important role in steering interest rates, managing the liquidity situation in the market and signalling the monetary policy stance.

Click here on more information on Open market operations

Standing facilities

Standing facilities aim to provide and absorb overnight liquidity, signal the general monetary policy stance and bound overnight market interest rates. Two standing facilities, which are administered in a decentralised manner by the NCBs, are available to eligible counterparties on their own initiative.

More information on Standing facilities

Minimum reserve requirements

The intent of the minimum reserve system is to pursue the aims of stabilising money market interest rates, creating (or enlarging) a structural liquidity shortage and possibly contributing to the control of monetary expansion.

More information on Minimum reserve requirements

Video 1 of 3