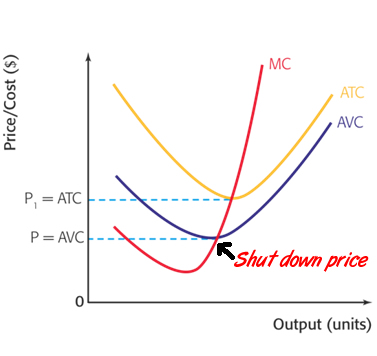

Shut Down Price

The goal of a firm is to maximize profits or minimize losses. The firm can achieve this goal by following two rules.

First, the firm should operate where MR = MC.

Second, the firm should shutdown rather than operate if it can reduce losses by doing so.

The shutdown rule states "in the short run a firm should continue to operate if price exceeds average variable costs." In other words, the rule is that for a firm to continue producing in the short run it must earn sufficient revenue to cover its variable costs. The rationale for the rule is straightforward. By shutting down a firm avoids all variable costs. However, the firm must still pay fixed costs. Because fixed cost must be paid regardless of whether a firm operates they should not be considered in deciding whether to produce or shutdown. Thus, in determining whether to shut down a firm should compare total revenue to total variable costs (VC) rather than total costs (FC + VC). If the revenue the firm is receiving is greater than its total variable cost (R > VC) then the firm is covering all variable cost plus there is additional revenue (“contribution”), which can be applied to fixed costs.

On the other hand if VC > R then the firm is not even covering its production costs and it should immediately shut down. The rule is conventionally stated in terms of price (average revenue) and average variable costs. The rules are equivalent (If you divide both sides of inequality TR > TVC by Q gives P > AVC). If the firm decides to operate, the firm will continue to produce where marginal revenue equals marginal costs because these conditions insure not only profit maximization (loss minimization) but also maximum contribution.

In the diagram above, the firm will shut down its operation if the Price goes below P, because it will not able to cover even its variable cost. Thus P is the shut down price.