Final Accounts

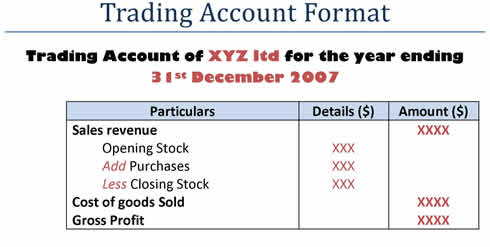

Trading Account

The trading account reveals the gross profit of the business.

Gross profit is the difference between sales revenue and the direct cost of the goods sold.

Cost of goods sold is the cost of purchasing the goods from suppliers (in case of retailing business) or the cost of producing the goods that are sold.

download 'Trading account/Profit and Loss account format' handout ![]()

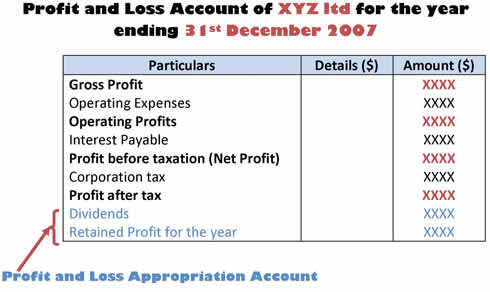

Profit and loss account

This account shows the net profit of the business.

Net profit = (Gross Profit – Expenses and Overheads) + Income from non trading activities

Appropriation account is that part of the profit and loss account which shows how the profit after tax is distributed. This profit can be distributed as dividends or can be kept in the company as retained profits.

Watch a Video

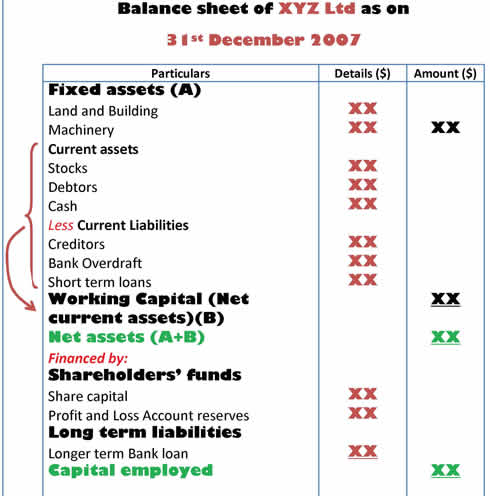

Balance Sheet

Balance sheet shows the value of a business’s assets and liabilities on a particular date.

It records what the firm owns (assets), what it owes (liabilities), what it is owed and how it is financed (owner’s equity).

Watch a Video

download 'Balance Sheet Format' handout ![]()

Balance Sheet Terms

Assets: all those items of value which are owned by the business. Assets are further categorized as fixed assets and current assets.

Fixed Assets: All those assets which are owned by the business for a period of more than one year. Example Vehicle, machinery, land, building.

Current Assets: all those assets which are owned by the business for a short period of time. Example Cash, stock, debtors.

Liabilities: All items owed by the business. Liabilities can be classified in two types:

Long term liabilities: These are long term borrowings which are owed by the business for more than one year. Example include long term bank loans.

Current liabilities: These are defined as obligations or debts of the business which have to be settled within one year. Example includes Creditors and bank overdrafts, stock.

Working Capital: Also known as net current assets= Current assets - Current liabilities

Working capital is needed for the day to day functioning of the business. A shortage of working capital can lead to cash flow problems.

Net assets: Fixed assets + Working Capital

Shareholders’ fund is the total sum of money invested into the business by the shareholders.

Capital employed: It is the total long term liabilities and shareholders’ funds which have been used to pay for the net assets of the business.

Capital employed = Net assets

Accounting Equation

Assets= Liabilities + Shareholder’s funds