Freely floating exchange rate

Exchange rate is the rate at which one country’s currency can be exchanged for another country’s currency.

Floating Exchange Rate

Floating exchange rate system means that the exchange rate is allowed to fluctuate according to the market forces without the intervention of the Central bank or the government.

Appreciation and Depreciation

The exchange rate for any currency usually fluctuates. When the value of the currency goes up as compared to other currency it is known as appreciation. When the value of currency falls as compared to other currency it is known as depreciation.

Usually the exchange rates are determined by the demand and supply of that currency in the international market.

Demand for any country’s currency on the foreign exchange market is determined by demand for that country’s exports of goods and services and by changes in foreign investment in that country. This is because when foreigners buy another country’s exports of goods or services they must pay for these in the currency of the exporting country.

In the same way Supply of any country’s currency on the foreign exchange market is determined by that country’s imports of goods and services and by its investment in other countries.

Thus when the demand for a currency rises its price goes up and it becomes costlier.

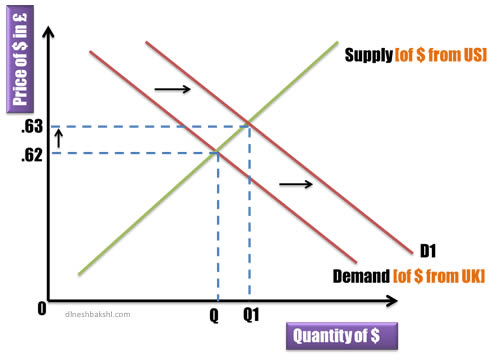

As we can see in the diagram as the demand for $ from UK increases it price in terms of £ goes up from .62 to .63.

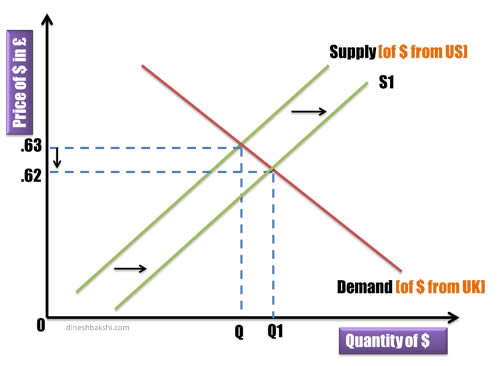

Similarly, we can see that the supply of dollar in the market increases which forces its price down from .63 to .62.

What causes the fluctuation in currency value?

Changes in the imports and exports of the country: An increase in exports of a country will lead to an increase in demand for the currency and thus the value rises.

Changes in Interest rate: Higher interest rate will attract more foreign investors to invest in the country and thus the demand for currency will rise, resulting in appreciation in value of the currency.

Changes in Inflation rate: Higher inflation rate will make the country uncompetitive in the international market. The exports will fall resulting in decreased demand for the currency and hence lower value.

Rise in domestic income relative to incomes abroad: currency depreciates.

Investment opportunities: if bright lead to appreciation.

Speculative sentiments: Individuals and institutions invest in currency markets with the sole intention to get short term gains. This is quiet like investing in stock exchange. Whenever a currency is going strong, people will invest more in an expectation to gain from it. This fuels the demand for that particular currency and it appreciates further.

Global trading patterns: if strong global presence in trade then the currency appreciates.

Changes in relative inflation rates: high inflation rate leads to exports becoming less competitive in international market

Effect of exchange rate changes

Exchange rate fluctuation effects country’s inflation rate, employment, economic growth and current account balance.

Lets see how…

Scenario 1- Currency depreciates

A depreciation in exchange rate should lead to a rise in demand for exports and a fall in demand for imports – the balance of payments should ‘improve’,

Exports will improve, this will lead to more output, more employment will be created thus economic growth will be achieved. However, exports is a component of AD, an increase in exports will lead to the shift of AD to the right and might also lead to inflation. The economy might also suffer from ‘imported inflation’ as imports are now expensive due to depreciation of your currency.

Scenario 2 – Currency appreciates

An appreciation of the exchange rate should lead to a fall in demand for exports and a rise in demand for imports – the balance of payments should get ‘worse’.

When exports fall, real output will fall which leads to unemployment. Economic growth is compromised and the economy may suffer from ‘deflationary gap’.

However, The volumes and the actual amount of income and expenditure will depend on the relative price elasticity of demand for imports and exports. Refer to Marshall-Lener curve.

Watch a Video