Monetary policy and the economy

Monetary policy is the process by which the government, central bank, or monetary authority of a country controls the supply of money, availability of money, and cost of money or rate of interest, in order to attain growth and stability of the economy.

Monetary policy is generally referred to as either being an expansionary policy, or a contractionary policy.

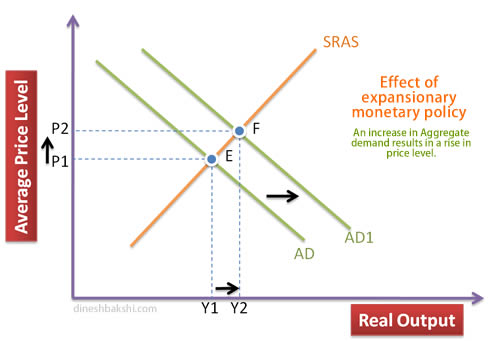

An expansionary policy increases the total supply of money in the economy and is traditionally used to combat unemployment in a recession by lowering interest rates. Lowered interest rates encourage the household and the firms to increase their consumption and investment respectively. This will shift the AD to the right and result in higher real output and more employment.

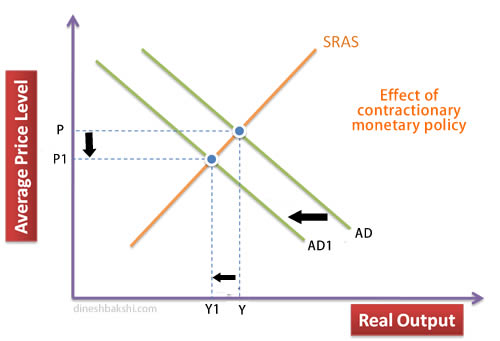

Contractionary policy decreases the total money supply and involves raising interest rates in order to combat inflation. The result will be that investment will fall, and consumption will fall. All of these changes will shift the AD to the left.

It is argued that an increase in the money supply causes an increase in the rate of inflation. Maintaining a low and stable inflation is one of the main macroeconomic objectives of the Government. Government does so by controlling the supply of money to the economy. This policy is known as monetary policy.

Monetary policy in any country is usually controlled by the Central Bank of that country. The Central bank alters the interest rates in the economy after assessing the inflationary pressures in the market.

Monetary Policy tools

Central Bank has three tools of monetary policy:

Open market operations

- Open market purchases: The central bank buys government securities to increase the monetary base.

- Open market sales: The central bank sells government securities to decrease the monetary base.

Open market operations have a number of advantages:

- They are under the direct and complete control of the central bank

- They can be large or small.

- They can be easily reversed.

- They can be implemented quickly

Discount loans

When a bank receives a discount loan from the central bank, it is said to have received a loan at the “discount window.” The Central Bank can a?ect the volume of discount loans by setting the discount rate:

- A higher discount rate makes discount borrowing less attractive to banks and will therefore reduce the volume of discount loans.

- A lower discount rate makes discount borrowing more attractive to banks and will therefore increase the volume of discount loans.

Discount lending is most important during ?nancial panics:

- When depositors lose con?dence in the ?nancial system, they will rush to withdraw their money.

- This large deposit out?ow puts the banking system in great need of reserves.

- The central bank stands ready to supply these reserves by making discount loans. In such situations, the central bank acts as a lender of last resort.

Changes in reserve requirements

The portion (expressed as a percent) of depositors' balances banks must have on hand as cash. This is a requirement determined by the country's central bank. It affects the money multiplier; changes in the required reserve ratio can lead to changes in the money supply. This is also referred to as the "cash reserve ratio" (CRR).