Indirect taxes

An indirect tax is a tax collected by an intermediary i.e. seller, from the person who bears the ultimate economic burden of the tax i.e. consumer.

It is imposed on expenditure. In simple terms, it is a tax which is imposed on goods and services sold. It is usually added to the cost of the good or service and charged from the ultimate consumer. The seller will then file a return to the government on all the taxes he has collected from the consumer.

Examples are sales tax and excise duty

Reasons for imposing taxes

The main reasons for government imposing taxes can be

- To generate Government revenues: excise duties on beers, wines and spirits are price inelastic in demand, so tax price increases by levying specific alcohol and tobacco taxes raise consumer expenditures as a whole on these categories and therefore taxation revenues;

- To discourage consumption: Government might use taxes to discourage consumption of certain demerit goods such as cigarettes.

- To alter the pattern of consumption: Government might use direct taxes a a mean to alter the consumption patter of its population. Certain goods can be made more price attractive through lower taxes while goods which have high marginal social cost can be made expensive through taxation.

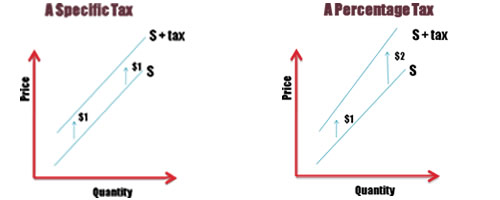

Distinction between specific and ad valorem taxes

- Specific tax is a flat rate of tax whereas ad valorem tax is a percentage tax.

- Ad valorem literally the term means “according to value.” It is imposed on the basis of the monetary value of the taxed item.

- A specific tax is when specific amount is imposed upon a good, for example $10 on each mobile phone sold; whereas ad valorem tax is expressed as a percentage of the selling price e.g. 12% of the sales.

- The amount of specific tax changes in the same proportion as the quantity sold increase, whereas, in ad valorem the tax collected is more at higher prices then at lower prices.

Consequences of imposing indirect tax

Imposition of tax results in three economic observations.

- Incidence: Incidence of tax means the party who actually pays the tax.

- Government revenue: the amount of tax government will receive as revenue

- Resource allocation: the amount of fall in quantity demanded and produced created by the tax.

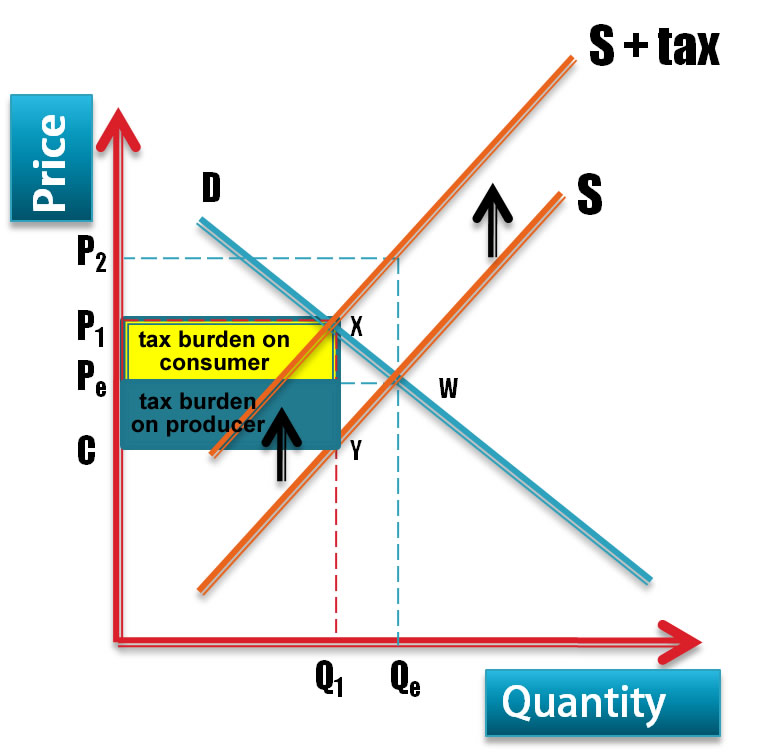

Incidence or tax burden

When a tax imposed on a good or service increases the price by the amount of the tax, the burden of the tax falls on consumers.

If instead it lowers wages or lowers prices for some of the other factors of production used in the production of the good or service taxed, the burden of the tax falls on owners of these factors.

If the tax does not change the product’s price or factor prices, the burden falls on the owner of the firm—the owner of capital.

If prices adjust by a fraction of the tax, the burden is shared. The incidence of tax will be shared between the consumers and producers, depending on the price elasticity of demand (PED) for that product (which we will discuss later).

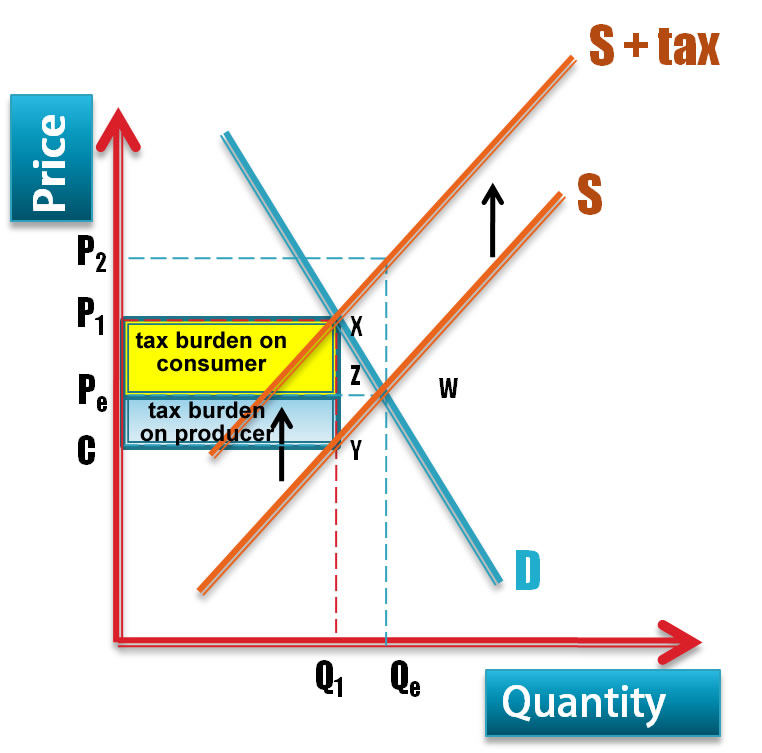

If we assume that the burden is equally shared by both the consumers and the producers then the size of square CYZPe is equal to PeZXP1. This means the incidence of tax is equally distributed by both the consumer and producer.

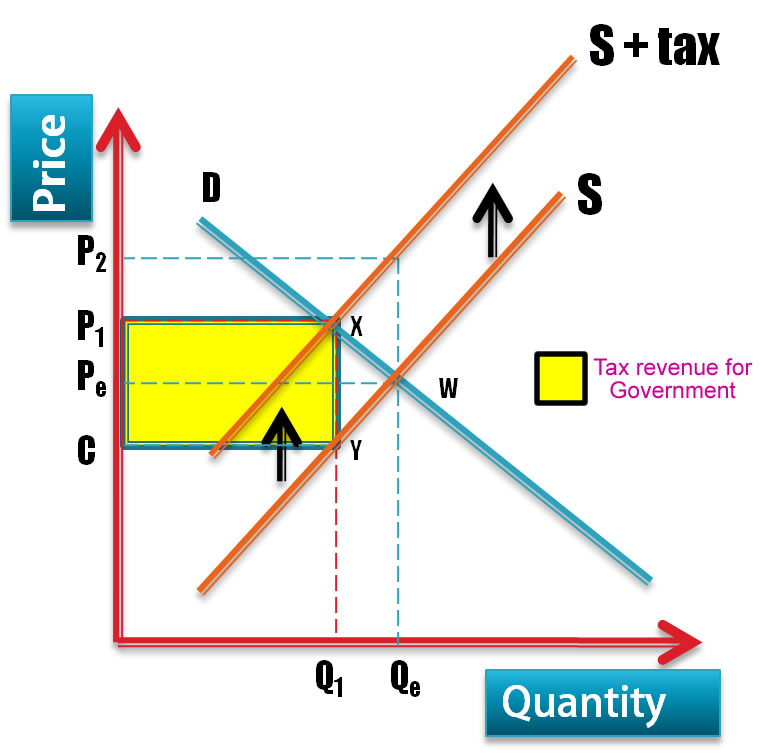

Government revenue

Putting taxes on goods and services generates revenue for the government.

Figure below shows the shaded region as tax revenue for government i.e. CYXP1. The implication will be a fall in output from Qe to Q1 and thus the consumption and production of the commodity will fall.

Tax incidence and price elasticity of demand and supply

Incidence of indirect taxes on consumers and firms differs, depending on the price elasticity of demand and on the price elasticity of supply. Let’s study individual cases.

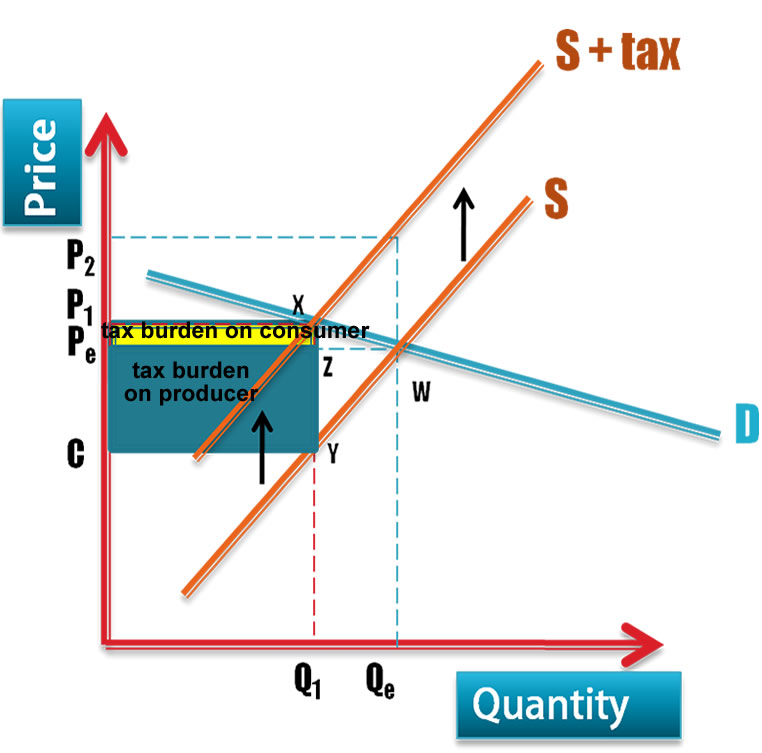

Scenario 1: When PED is greater than PES

Where PED is greater than PES, it implies that consumers are more sensitive to price changes as compared to suppliers. Thus the incidence of tax will be more on the suppliers because if too much burden of tax is passed on to the consumers then the demand will fall drastically. Therefore, this time the price paid by buyers barely rises; sellers bear most of the burden of the tax.

Scenario 2: When PES is greater than PED

When the supply curve is relatively elastic, the bulk of the tax burden is borne by buyers. This is because PED as compared to PES is elastic, which means; consumers are not that price sensitive and will not reduce their consumption even if the prices rise. Because the PES is elastic, suppliers will stop the supply if the cost of production goes up. Therefore, buyers end up getting higher burden of tax.

Scenario 3 : PED is equal to PES

In this case both the producer and consumer will share equal burden of tax.