Government Intervention in the exchange rate

Fixed Exchange Rate

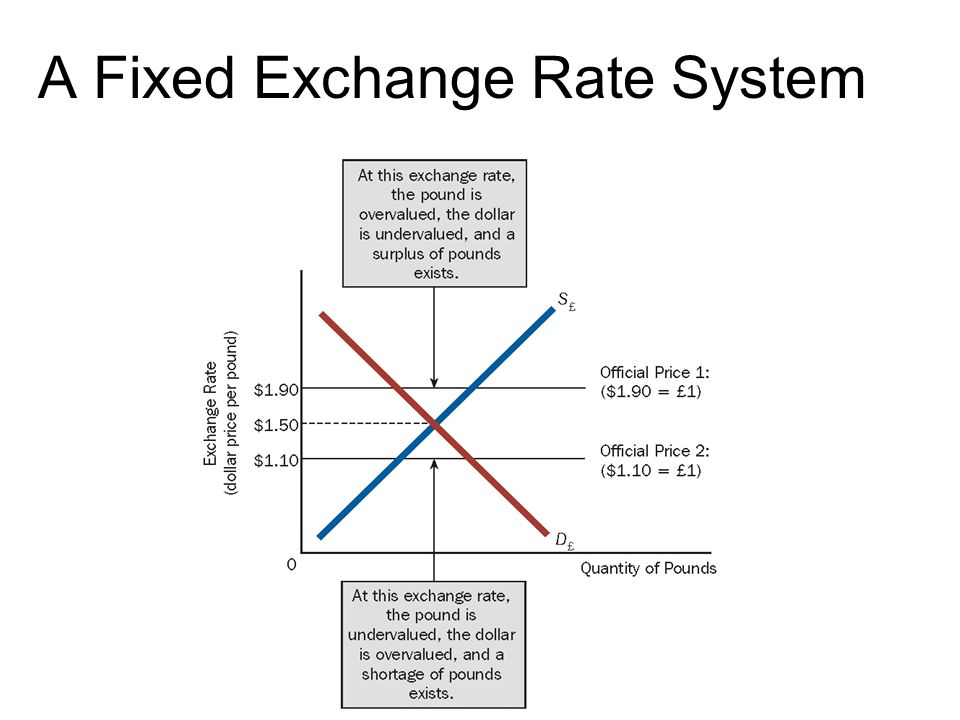

A fixed exchange rate system refers to the case where the exchange rate is set and maintained at same level by the government irrespective of the market forces.

The diagram below shows a fixed exchange rate

Revaluation and Devaluation

It refers to official changes in the price of a currency in a fixed exchange rate system.

- Devaluation is when the price of the currency is officially decreased in a fixed exchange rate system.

- Revaluation is the official increase in the price of the currency within a fixed exchange rate system.

Managed Exchange Rate

A managed exchange rate occurs when there is official intervention by a government or an agency such as the Central Bank to determination the value of a country’s exchange rate. Through such official interventions it is possible to manage both fixed and floating exchange rates.

For example,

The Fedral Bank may decide to enter the foreign exchange market as either a buyer or seller to stabilise any short-term fluctuation in the value US$. To limit a fall in the value of US$ (depreciation) the Fed will buy US$, and to prevent a rise in the value of US$, the central bank will sell US$ in the market.

Such intervention by the central bank is known as a “dirty float”, or more correctly a “managed float”.

Other Government actions and their effect

Expansionary monetary policy (↑MS) causes an increase in GNP and a depreciation of the domestic currency in a floating exchange rate system in the short run.

Contractionary monetary policy (↓MS) causes a decrease in GNP and an appreciation of the domestic currency in a floating exchange rate system in the short run.

Expansionary fiscal policy (↑G, ↑TR, or ↓T) causes an increase in GNP and an appreciation of the domestic currency in a floating exchange rate system.

Contractionary fiscal policy (↓G, ↓TR, or ↑T) causes a decrease in GNP and a depreciation of the domestic currency in a floating exchange rate system.

In the long run, once inflation effects are included, expansionary monetary policy (↑MS) in a full employment economy causes no long-term change in GNP and a depreciation of the domestic currency in a floating exchange rate system. In the transition, the exchange rate overshoots its long-run target and GNP rises then falls.

A sterilized foreign exchange intervention will have no effect on GNP or the exchange rate in the AA-DD model, unless international investors adjust their expected future exchange rate in response.

A central bank can influence the exchange rate with direct Forex interventions (buying or selling domestic currency in exchange for foreign currency). To sell foreign currency and buy domestic currency, the central bank must have a stockpile of foreign currency reserves.

A central bank can also influence the exchange rate with indirect open market operations (buying or selling domestic treasury bonds). These transactions work through money supply changes and their effect on interest rates.

Purchases (sales) of foreign currency on the Forex will raise (lower) the domestic money supply and cause a secondary indirect effect upon the exchange rate.